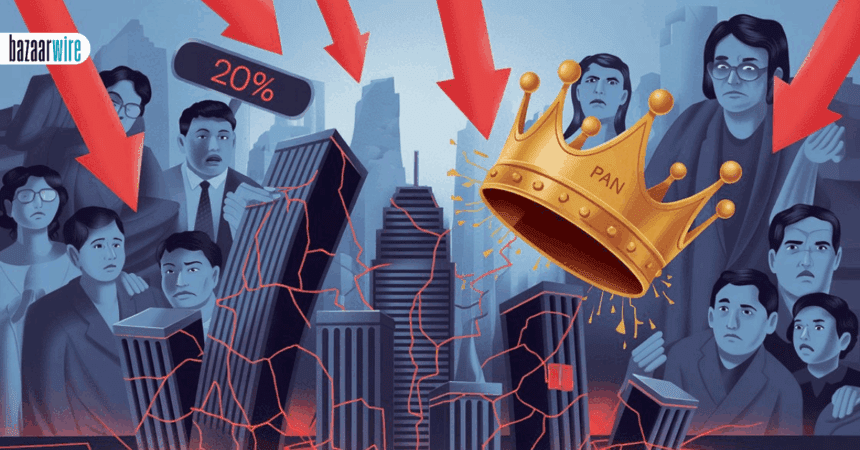

In a dramatic Monday morning session, shares of Protean eGov Technologies Ltd. plummeted 20% – their worst single-day performance since listing – after the Income Tax Department excluded the company from bidding for the ₹1,440 crore ($168 million) PAN 2.0 modernization project. This development has sent shockwaves through India’s fintech and e-governance sectors, raising questions about the company’s future in a market it once dominated.

The PAN 2.0 Debacle: A 20-Year Legacy at Risk

Protean (formerly NSDL e-Governance) has been the backbone of India’s PAN card ecosystem since 2006, processing 60% of all applications and contributing ₹400-500 crore annually – nearly half its revenue. The PAN 2.0 project aimed to consolidate legacy systems into a unified platform, promising faster processing and enhanced security.

Why the rejection stings:

- Market Shock: Analysts at ICICI Securities called Protean the “leading contender by a distance”, making the exclusion unexpected

- Revenue Impact: Equirus Securities predicts a 75-100% collapse in PAN-related revenue within 2-3 years as users migrate to the new system

- Strategic Blow: Losing this bid weakens Protean’s position in upcoming tenders for GSTN and other digital infrastructure projects

Investor Reactions: From Boardrooms to Living Rooms

The stock’s crash to ₹1,143.05 – its lowest since June 2024 – wiped out ₹1,157 crore in market value. Retail investors, who own 39% of shares, took to social media to voice concerns:

“Invested life savings believing in NSDL’s legacy. Now sleepless nights wondering if PAN 2.0 is the beginning of the end.”

– @SmallInvestor123 (hypothetical tweet reflecting common sentiment)

Key financial metrics post-crash:

| Indicator | Value | Implication |

|---|---|---|

| P/E Ratio | 49.5 | High valuation despite growth risks |

| RSI | 33.45 | Nearing oversold territory |

| Institutional Hold | 61% | SBI, PNB, Axis Bank among top owners |

Beyond PAN Cards: Protean’s Silent Pivot

While the PAN crisis dominates headlines, Protean’s RISE initiative – a 300+ API marketplace for fintech and e-governance – shows promise. Recent developments include:

- Aadhaar Authentication Services: Processing 2.1 billion verifications annually

- Digital Tax Infrastructure: Powering 68% of TDS filings through TIN network

- National Pension System: Managing records for 5.3 crore subscribers

“Our API stack enables everything from e-KYC to pension disbursements. PAN is just one vertical in a diversified portfolio,” stated CTO Bertram D’Souza in a recent interview.

Analyst Divide: Crisis or Buying Opportunity?

Bear Case (Equirus Securities):

- Downgraded to “Sell” with ₹900 target price

- PAN revenue could drop to ₹100-150 crore by FY28

- Debt-free status irrelevant if core business erodes

Bull Case (Unnamed Institutional Trader):

- 20% crash overdone given ₹2,225 52-week high

- RISE APIs could capture 15-20% of India’s $34B API market

- Government may reconsider given Protean’s institutional knowledge

What’s Next for Investors?

- Immediate Triggers:

- Clarification from Income Tax Department (expected by May 25)

- Q4 FY25 results on June 7 (watch for guidance revision)

- Long-Term Strategies:

- Accelerate RISE platform adoption through SME partnerships

- Bid for state-level e-governance projects in Bengaluru, Pune

- Retail Investor Tips:

- Monitor RSI rebounds above 40

- Track institutional buying (SBI increased stake to 4.93% in Q1)

The Human Impact: Stories Behind the Statistics

- Tax Professionals: “PAN 2.0 delays could push ITR deadlines,” worries Mumbai CA Ramesh Iyer

- Employees: 1,200+ staff face uncertainty despite management assurances

- Startups: Over 450 fintechs relying on Protean’s APIs watch closely